FHA Home Loans: Easy Tips to Protect Your Dream Home

FHA Home Loans: Easy Tips to Protect Your Dream Home

Blog Article

The Ultimate Resource on Home Loans: A Comprehensive Look at Various Finance Programs and Their Benefits for Consumers

Navigating the landscape of home finances can be a difficult task, especially with the myriad of choices readily available to possible debtors. Each loan program-- be it standard, FHA, VA, or USDA-- provides distinct advantages that provide to varying monetary situations and homeownership objectives. Comprehending these nuances is essential for making informed decisions that line up with one's monetary future. As we discover these car loan programs further, it ends up being noticeable that the appropriate choice may not be as straightforward as it seems, triggering much deeper factor to consider of what each alternative genuinely involves.

Comprehending Traditional Fundings

Traditional fundings stand for a considerable portion of the home financing market, interesting a variety of debtors because of their structured terms and competitive passion prices. These financings are usually not insured or guaranteed by the federal government, distinguishing them from government-backed lendings such as FHA or VA lendings. Rather, standard lendings are supplied by personal lenders, which permits for higher versatility in problems and terms.

Usually, standard fundings can be found in two types: adapting and non-conforming. Adapting lendings comply with the standards established by Fannie Mae and Freddie Mac, consisting of restrictions on lending quantities, borrower credit rating, and debt-to-income proportions. Non-conforming fundings, on the other hand, do not satisfy these criteria and may deal with customers with one-of-a-kind monetary scenarios.

Customers often discover that standard car loans give eye-catching options for down repayments, with some calling for just 3% down. Furthermore, those with solid credit profiles might profit from lower rate of interest prices contrasted to other alternatives. On the whole, traditional fundings are a sensible choice for numerous property buyers, supplying a blend of cost and access in the affordable housing market.

Exploring FHA Financing Benefits

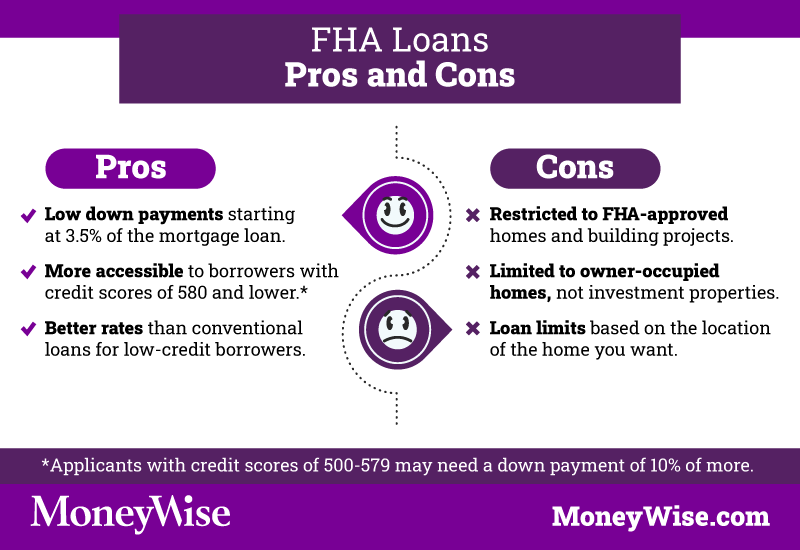

A considerable variety of buyers turn to FHA fundings as a result of their enticing benefits, especially for those that might encounter challenges securing traditional funding. The Federal Real Estate Administration (FHA) insures these finances, making them accessible for debtors with reduced credit history and smaller down settlements. Generally, FHA financings call for a deposit of simply 3.5% for those with credit rating scores of 580 or greater, significantly decreasing the upfront cost of purchasing a home.

In addition, FHA loans have adaptable credentials standards that fit a larger variety of financial scenarios. This consists of allowances for higher debt-to-income proportions, allowing debtors with existing financial obligations to obtain financing (FHA home loans). FHA finances likewise allow the use of gift funds from household participants or organizations to cover down settlement and closing expenses, relieving the economic problem on buyers.

Advantages of VA Loans

VA loans provide various advantages for qualified veterans, active-duty service participants, and specific members of the National Guard and Gets. One of one of the most substantial advantages is the lack of a deposit demand, permitting consumers to fund 100% of the home's value. This function makes homeownership more accessible for those that have served in the military.

Furthermore, VA loans do not call for exclusive mortgage insurance policy (PMI), which can conserve customers significant monthly costs compared to click now conventional loans. The rate of interest rates on VA finances are generally less than those of other finance types, further improving price. VA fundings come with versatile debt demands, making them an eye-catching choice for people who might have less-than-perfect credit rating backgrounds.

Another secret benefit is the option for professionals to get beneficial loan terms, including the opportunity of refinancing with the Streamline Refinance alternative, which can lower regular monthly settlements. VA car loans use an one-of-a-kind feature of assumability, allowing future buyers to take over the finance under the very same terms, which can be a marketing factor when reselling the home - FHA home loans. Generally, VA financings provide important benefits that cater particularly to the demands of military personnel and their households

Insights Into USDA Financings

Checking out the advantages of USDA loans exposes a sensible financing alternative for property buyers in suburban and country locations. The USA Division of Agriculture (USDA) provides these fundings to promote homeownership, particularly targeting low to moderate-income families. Among one of the most substantial benefits is the absolutely no down settlement need, making it easier for eligible buyers to purchase a home without the concern of a significant first financial investment.

USDA loans likewise include competitive rates of interest, which usually cause reduced regular monthly payments compared to standard funding. In addition, these finances do not need personal mortgage insurance policy (PMI), additional minimizing the general cost of homeownership. Customers can fund not just the acquisition cost but likewise shutting prices, making it an eye-catching choice for those with limited economic resources.

Qualification for USDA helpful resources fundings is determined by revenue limitations, which differ by place and family dimension, making sure that support is guided to those that need it most. With adaptable credit requirements, USDA lendings are available to a wider series of applicants, promoting area growth and security in country and rural locations. Generally, USDA loans represent an essential tool for advertising equity in housing chances.

Contrasting Car Loan Programs

Traditional finances are frequently attractive due to their adaptability and the opportunity of avoiding home mortgage insurance with a greater deposit. On the other hand, FHA loans give chances for consumers with reduced credit rating and smaller down repayments, making them accessible for newbie customers. VA fundings stick out for experts and active-duty solution members, providing beneficial terms such as no down repayment and affordable rate of interest rates.

USDA car loans particularly deal with country buyers, promoting budget-friendly housing in less booming areas with no deposit alternatives. Each program has specific qualification criteria, including revenue limitations and property place constraints, which ought to be meticulously assessed.

Eventually, performing a complete contrast of financing programs entails assessing rates of interest, loan terms, find out and closing costs, together with individual economic circumstances. FHA home loans. This tactical technique will certainly encourage borrowers to make informed decisions that line up with their long-term financial goals

Verdict

Finally, an understanding of various home mortgage programs is necessary for potential debtors seeking to make educated decisions. Each funding type, including standard, FHA, VA, and USDA, provides distinctive advantages tailored to details financial scenarios and needs. By examining the unique benefits of these alternatives, individuals can choose one of the most suitable finance that aligns with their homeownership goals, eventually facilitating a much more easily accessible course to achieving homeownership and monetary stability.

These financings are commonly not insured or ensured by the federal government, identifying them from government-backed finances such as FHA or VA financings. Adjusting loans stick to the standards established by Fannie Mae and Freddie Mac, including limits on funding quantities, consumer credit report ratings, and debt-to-income proportions.Rate of interest prices on FHA financings often tend to be affordable, providing borrowers with lower monthly payments compared to conventional lendings.Additionally, VA car loans do not need personal mortgage insurance coverage (PMI), which can save customers substantial monthly costs contrasted to standard financings. VA financings supply an one-of-a-kind attribute of assumability, enabling future purchasers to take over the car loan under the exact same terms, which can be a selling point when re-selling the residential property.

Report this page